About

1:55 AM

/

/

2 min read /

/

CorrGrid provides access to ~100 billion precomputed, survivorship bias-free, sophisticated pairwise correlation and cointegration metrics, powering CorrGrid’s cutting-edge selection tools, which identify pairs, triplets, or quadruplets of stocks, revealing hidden market topology and providing associated hedge ratios, betas, and weights.

CorrGrid is a service designed for portfolio managers, quantitative analysts (quants), traders, and analysts seeking insights for pairs trading, statistical arbitrage, correlation and cointegration analysis, mean-reversion strategies, and exploring hidden market structure via topology analysis.

CorrGrid Correlations

- Top and Bottom Correlations: The 10,000 most positively and 10,000 most negatively correlated pairs exhibiting strong mean-reversion properties and sufficient1 residual volatility for real-world strategy implementation, selected and filtered2 from over 10 million pairs.

- Kendall’s tau: Robust correlation measure converted to the Pearson scale for improved interpretability.

- Betas & Hedge ratios: Calculated and provided for all pairs. These can be used to construct market-neutral portfolios, implement mean-reversion strategies, and for hedging.

CorrGrid Cointegrations

- Johansen’s method: The Johansen’s eigenvalue method offers a way to quantify the strength of cointegration.

- Top cointegrations: The 20,000 most cointegrated pairs, triplets, and quadruplets, selected from over 10 million computations for a specific date, based on both Johansen’s method and the ADF test.

- Betas & Hedge ratios: Calculated and provided for all cointegrated pairs to facilitate the construction of mean-reversion and spread strategies.

- Spurious Cointegration Filtering: Leverages the revealed hidden topology (MST) to prioritize cointegration between variously connected instruments (e.g., same-sector, same-cluster, etc.).

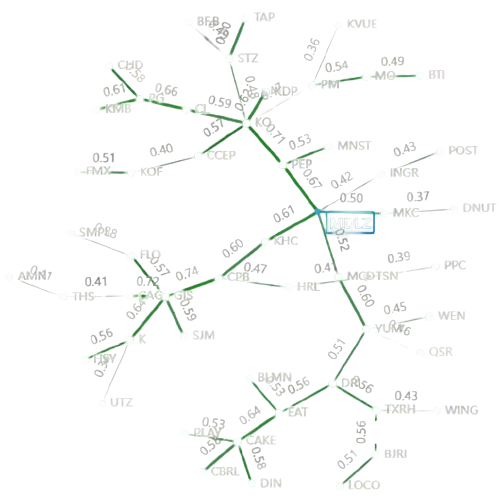

CorrGrid Market Topology

Provides deep insights into the structure of financial instrument correlations and market topology.

- MST (Minimum Spanning Tree): A connectivity tree constructed using Kruskal’s algorithm.

- Variants: Based on raw, ex-SPY, or ex-ETF cointegrations and correlations .

Common features

- Bias-Free: Correlation and cointegration data are free of survivorship bias (including delisted stocks), enabling historical interdependency analysis for specific past dates.

- Mid-Price: Utilizes quote prices (mid-prices) rather than transaction prices, avoiding side effects such as bid-ask bounce and delayed trade prices.

- Each product is available in three variants:

- raw

- ex-SPY, which excludes broad market movements using SPY as a proxy

- ex-ETF, which excludes sector-wide movements using the largest sector ETFs as proxies.

By removing these common external factors, the ex-SPY and ex-ETF variants reveal hidden interdependencies.

Disclaimer

The provided content and materials are not designed to serve as financial, investment, trading, or any other form of advice, nor should they be interpreted as recommendations endorsed or verified by CorrGrid or its affiliates. For more information, please visit Terms of Use